SIP or Systematic Investment Plan, is like a savings plan for investing. You commit to investing a fixed amount regularly, say monthly, and it's automatically invested in mutual funds. This helps you build wealth over time, as you benefit from the power of compounding and don't need to time the market. SIPs are a hassle-free way to grow your money steadily, regardless of market ups and downs.

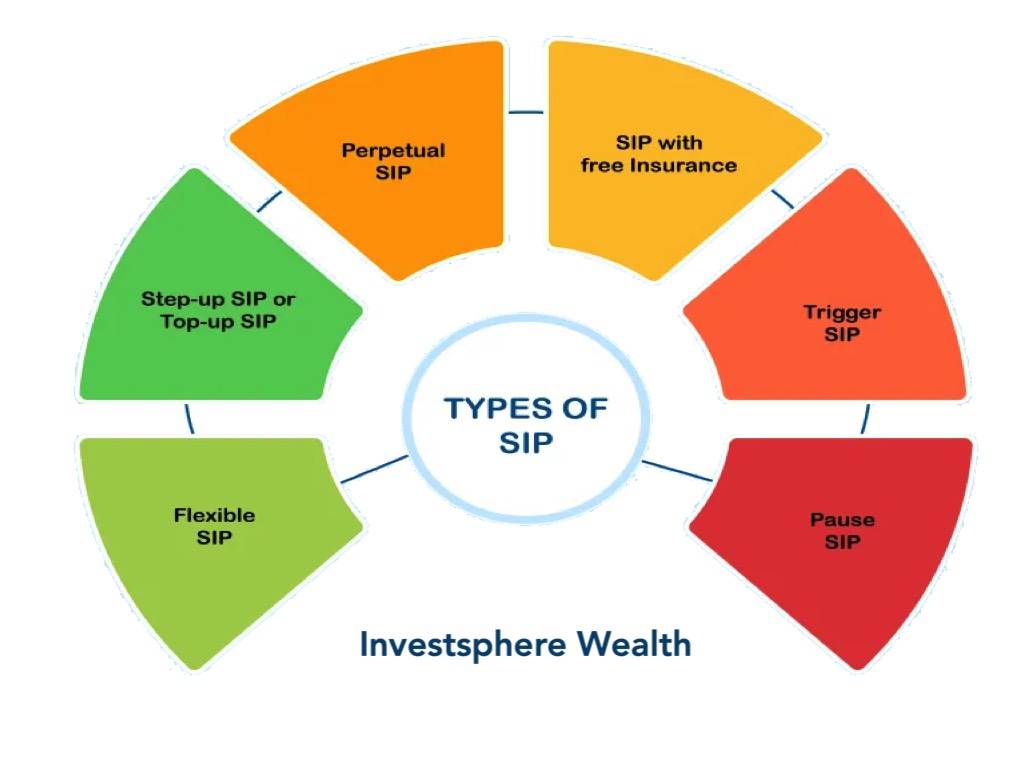

What are types of SIP's ?

Top-up SIP:

This type of SIP allows investors to increase their investment amount periodically by a predetermined percentage or fixed amount. It enables investors to enhance their savings as their income increases or when they have surplus funds available.

Flexible SIP:

Flexible SIPs allow investors to vary the amount of their SIP installment or the frequency of investments based on their financial situation or investment goals. It offers greater adaptability to changing financial circumstances.

Perpetual SIP:

Perpetual SIPs do not have a fixed investment period. Instead, they continue indefinitely until the investor decides to stop or modify the SIP. This type of SIP is suitable for investors who want to invest for the long term without specifying a specific duration.

Trigger-based SIP:

In trigger-based SIPs, investments are made based on predefined market triggers, such as reaching a certain price level or market index level. This type of SIP aims to capitalize on market opportunities or mitigate risks by automating investment decisions based on market conditions.

Step-up SIP:

Step-up SIPs allow investors to increase their SIP contribution gradually over time, either by a fixed amount or a percentage. This helps investors to accelerate their wealth accumulation by boosting their investments periodically.

Capital Appreciation SIP:

Capital appreciation SIPs focus on investing in mutual fund schemes that aim to generate capital appreciation over the long term. These SIPs are suitable for investors with a high-risk tolerance seeking higher returns through investments in growth-oriented assets like equities.

Dividend SIP:

Dividend SIPs allow investors to receive regular dividend payouts from their investments. Instead of reinvesting dividends, they can choose to receive them as income, providing a regular income stream while also benefiting from potential capital appreciation.

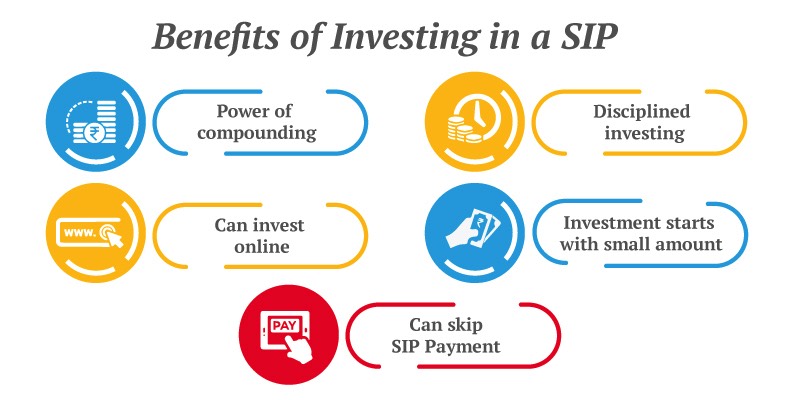

Benefit of Investing in SIP's ?

Disciplined Investing:

SIPs encourage disciplined investing by allowing investors to contribute a fixed amount regularly, typically monthly or quarterly. This helps inculcate a habit of saving and investing over time, regardless of market fluctuations.

Rupee-Cost Averaging:

SIPs enable investors to benefit from rupee-cost averaging. Since investments are made at regular intervals, more units are purchased when prices are low and fewer units when prices are high. This helps average out the cost of investments over time and reduces the impact of market volatility.

Power of Compounding:

SIPs harness the power of compounding to help investors grow their wealth over the long term. As the returns generated by mutual funds are reinvested, they have the potential to earn returns on both the principal amount and the accumulated returns, leading to accelerated growth over time.

Flexibility:

SIPs offer flexibility in terms of investment amount and frequency. Investors can choose the amount they want to invest and the frequency of investments based on their financial goals, risk tolerance, and cash flow requirements.

Diversification:

SIPs allow investors to diversify their investments across a wide range of mutual fund schemes, including equity funds, debt funds, and hybrid funds. This diversification helps spread risk and optimize returns based on the investor's investment objectives and risk profile.

Investment Starts With Small Amount:

SIPs are a cost-effective investment option as they typically have lower minimum investment requirements compared to lump sum investments. Additionally, many mutual fund houses offer SIPs with no entry or exit load, making them a cost-efficient way to invest.

Can Invest Online:

SIPs offer convenience as investors can automate their investments through standing instructions to their bank accounts. This eliminates the need for manual intervention and ensures that investments are made on time, regardless of market conditions.